Do you lose consulting projects to low-fee competitors? How do you handle that threat to your business? Below are (almost) seven strategies to thrive when fees are taking a dive.

Paella Consulting Associates is an advisor to the world’s crustacean industry. (True story, though the name and market have been changed.) For over 20 years they’ve offered their expert services at a premium and the firm steadily brings in around $8-10 million per year. Not a bad haul.

But this year, Shrimpy Co., an upstart company from Singapore entered the market.

Shrimpy has a thin shell of consulting talent supported by AI analysts, and they offer similar solutions and similar quality for about 70% lower fees than Paella. Yikes.

How can Paella respond to this international incursion that’s threatening their entire business?

7 Responses to Low-Price Competition in Consulting

Strategy #1: Recommit

(a.k.a. ”Don’t Change, Don’t Blink”)

With 20 years of reputation and relationships in the market, Paella could stick with their premium fees and ignore the bottom feeders.

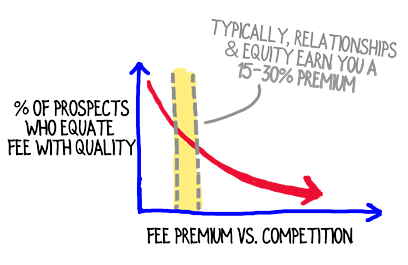

Some prospects equate higher fees with higher quality, and Paella’s not in immediate danger of losing all their clients.

This strategy works if you’re a little fish in a big pond.

However, if there’s only enough room for a few players in your pool and your prospects are price-sensitive, Recommit is a short-term play.

Strategy #2: Release

(a.k.a. “Throw Back the Little Fish”)

Paella could politely walk away when a prospect makes it clear there’s a bidding situation and the Singaporians are in the mix.

In other words, bow out of low-margin projects.

Similar to the Recommit strategy, Release is a viable strategy (for now) only if you’re a small fry swimming in a sea of opportunities.

Strategy #3: Retrench

(a.k.a. “Give In”)

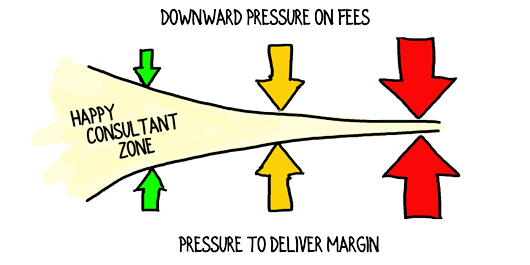

In the face of a cost-focused prospect and aggressive competition, Paella could react by lowering fees.

While this strategy is called Retrench, it could just as easily be named “Regret” since that’s where it invariably leads.

You’ll have to Retrench at times if you’re facing cash flow struggles; however, it can cause a vicious cycle of more work for less reward.

Strategy #4: Refocus

(a.k.a. “Try the Shiny Lure”)

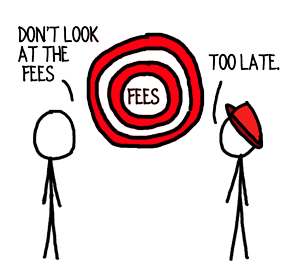

Many consulting gurus would admonish Paella to point their prospects to outcomes and value rather than inputs and costs.

This would be sound advice if it frequently worked. But it doesn’t.

Prospects invariably flip to the fee section of your proposal first. Attempts to Refocus won’t change that dynamic.

For Paella, whose fees may be three times as high as an AI-forward competitor promising equivalent quality, simply stressing value is a fool’s errand.

Strategy #5: Reframe

(a.k.a. “Change the Game”)

If the Paella consultants are clever, they’ll fundamentally alter their prospect’s view of the problem and/or the necessary solution, so that competitive offerings no longer fit the bill.

Reframe is a sophisticated technique that takes preparation and practice.

It requires consultants to smoothly wield compelling, epiphany-inducing models. In today’s world, it also means bringing insights and nuances to bear that AI can’t replicate.

A well-designed diagnostic deployed during the BD process will encourage prospects to Reframe themselves into a world where low-fee, AI-heavy solutions no longer make sense.

Consultants who are excellent at the Reframe strategy can save about 30-40% of projects that low-fee competitors otherwise would have hooked.

It’s not a panacea, but it’s one of the two best strategies available.

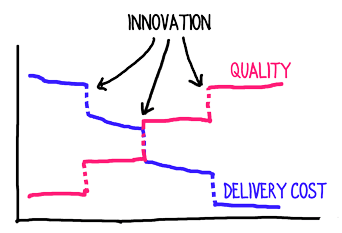

Strategy #6: Rethink

(a.k.a. Wake Up!)

Frankly, Paella had been asleep at the wheel. Since no firms had been able to match their quality for a couple of decades, they stopped innovating.

Big mistake.

If you consistently dish up sizeable earnings, eventually a consultant is going to figure out how to match your quality (or exceed it) at a fraction of the cost.

With the advent of LLMs, “eventually” for many consulting firms has shrunk from years down to months.

The question Paella has to answer is, “How do we deliver the same quality as always, but cut our costs by 80%?”

Even before AI hit the scene, there was always an answer to this question. Now, if you’re not actively looking for ways to drive delivery costs down 80%, you’re putting your firm at risk.

In the long run, applying Rethink to your offering, your approach and your delivery is always the best strategy.

Combined with Recommit or Reframe, it also can deliver a hypodermic of adrenaline to your margins.

Strategy #7: ?

(a.k.a. “My Request to You”)

Is there a strategy I’ve missed?

The six strategies above —or some subset—are what my team and I usually present to clients facing Paella’s situation.

I’m interested in your additions, though.

How else do you respond to low fee competitors?

Text and images are © 2026 David A. Fields, all rights reserved.

David A. Fields Consulting Group

David A. Fields Consulting Group

Innovation and technology can be used to decrease costs to client or improve quality of the work product. There is another variable. Consider using innovation and technology to offer more to the client. Those new features may not yet be offered by competition. If you offer new features or extra support with little new inputs, you can offer more to a client at the same price and very similar margin – while still defining yourself as the go-to consultant for best results.

Will the competition catch on and start offering the same features? Sure. By the time they do, you can innovate some more and build even more new low-cost features. The cycle improves your product and shows your leadership in the field.

Absolutely right, Peter. Both sides of the coin–cost and value–should be the focus of a consulting firm’s innovation efforts. Thank you for highlighting that!

My biggest selling point when going against low-cost competition is focusing on the value proposition of having a trusted consultant in person or available versus a technology solution. This works especially well where companies have been burned by a low-cost solution in the past. I get a lot of my work from clients that went cheap and paid the price for using a cheap solution.

Exactly, Diane. This ties to the story (mentioned elsewhere) about the Auto Shop with the $99 Brake Repair sign and the one across the street with this sign: “Brake repair $299. Collision repair from $99 brake jobs: $9,999.”

That said, some clients only want the cheap solution. It’s worth sorting out which class your prospect belongs to.

Thanks for joining the conversation, Diane.

Seek to understand your client’s mindset – their perceptions of constraints and opportunities – and check their assumptions against their competitors. When you understand the gaps, you can teach your clients methods to improve their competitiveness in their market. Instead of delivering a “solution” – teach them how to continuously identify problems and collaboratively solve problems with their trusted consultant.

As you’ve deftly suggested, Loraine, when you understand your prospect far better than the competition, you become the obvious choice. Elevating their position beyond solving the immediate problem at hand also can separate you from consultancies who are only addressing the immediate need.

I’m glad you chimed in, Loraine!

“It’s a terrible strategy to be the second cheapest offer in your space.” You must differentiate yourself against your competition – especially versus low-cost providers. But you NEVER engage in and try to “win” the race to the bottom.

That’s a GREAT quote, Dirk! As others have said, if you win the race to the bottom, is that a good thing?!

Interestingly, our research into how clients choose (which is based on a pretty rich data set), shows the vast majority of consulting firms in competitive situations are not selected based on fees. Yes, fees enter into the equation and in about 20% of cases fees are the dominant choice driver. However, you can be as much as 3x the price of competition and still win the engagement, particularly if you Reframe.

Thanks for the excellent contribution to the conversation, Dirk.

Strategy #5: Reframe and Strategy #6: Rethink. Look forward to digging into these further. From what I’ve seen, clients tend to respond best to a mix of strategy and execution, paired with very specific geographic and industry context. That said, there may be more sophisticated ways to approach this.

Separately, thank you for addressing my earlier question in Monday’s 15-minute workshop. I spoke with two current and former leaders in the organization who appreciated our work. Based on those conversations, the new leader is expected to soften his feedback, and I’m looking forward to seeing how that plays out next week. We didn’t need to offer services pro bono, though I’d still be open to it if it proved useful.

Steven you’re 100% right about industry expertise–that’s the most common, #1 attribute clients look for in a consultant. Geographic expertise is in the mix, especially in geographies that see themselves as unique or somewhat self-contained, such as Puerto Rico. Cultural understanding (e.g., deep understanding of the Japanese approach to leadership) is often more of a concern than geographic experience.

There are many, many ways to approach Reframe, of course. As long as you shift your prospect’s view of what’s required away from the commodity thinking they have now, you can win at a premium.

You’re welcome for the Monday Q&A response. Congratulations on the progress with that client! (For those wondering, Steven’s question was addressed during our every-Monday, free Q&A: https://davidafields.com/mondaylive)

I appreciate your sharing your feedback and thoughts, Steven!

Thank you David. Great points! Japan was one of the regions I had in mind. I’m seeing some signs of geographic uniqueness in Europe and the Middle East too.

Yes, we have a guide we give some clients that maps out cultural differences by region/country. It’s pretty interesting. Japan and the Middle-East (and areas within the Middle-East) are quite distinctive in their interaction with consulting firms.