The Investment Mindset: 7 Differences That Accelerate Your Consulting Firm’s Growth

When you add personnel to your consulting firm—be they full-time employees or contractors—are they a cost or an investment?

The mindset revealed in your answer to that question affects many aspects of your firm including your firm’s growth trajectory.

A handful of piercing questions reveal your approach to life and business, and explain your character, success, and happiness. For instance:

- Do you look at the world through a lens of abundance or of scarcity?

- Are your yardsticks of achievement internal or external?

- Do you see pancakes as a fattening, low-nutrition meal or a welcome opportunity to add chocolate chips to breakfast?

Add to this list: Do you regard staff as a cost or an investment?

Your answer to that question speaks to your overall cost-vs-investment mindset and carries particular relevance for your consulting firm.

The seven topics below illustrate how your cost vs. investment mindset drives your consulting practice and your growth prospects.

7 Implications of Your Cost/Investment Mindset

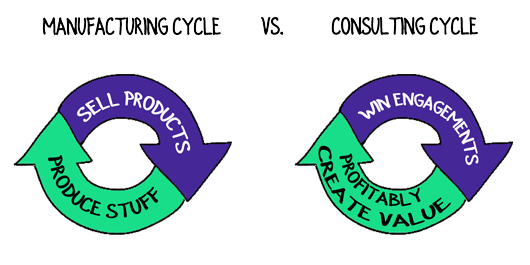

Business Cycle

With a cost mindset, your consulting business feels like commodity manufacturing:

You sell an extremely standardized offering and produce it for the lowest cost possible.

With an investment mindset, you experience consulting as responsive innovation:

You win engagements and profitably deliver engagements customized as necessary to maximize value.

Leading Success Metrics

As a cost-oriented firm leader, your leading KPIs are cost of goods sold (COGS) and utilization.

You want the lowest costs and you want to squeeze out every possible hour of billable time.

As an investment-oriented firm leader, your leading KPIs are net margin and productivity.

You are happier with a consultant who delivers $1M in projects while loafing half the day than with a consultant who works 80 hours/week to deliver $800K.

Positioning

When you have a cost orientation, you allow your clients to look at you as an expense.

You brag that your firm is a less expensive alternative to achieve their outcome than, say, big-name consulting firms.

With an investment orientation, you push clients to view your firm as an asset that enhances their performance.

You tout your ability to deliver a better outcome than internal staff or any other firm.

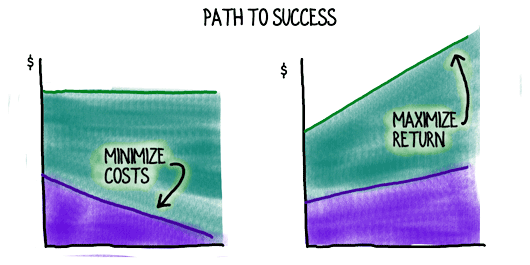

Pricing and Fee Structures

If your firm is cost-focused, your clients want to minimize their spend. You talk with them about costs.

You price projects on time and materials, accept fees based on hourly or daily rates, and focus on your cost of delivery.

If your firm is investment focused, your clients want to maximize their gain. You talk with them about value and upside possibility.

You price projects based on value created, structure contracts around your contribution to the outcome, and maximize your fees.

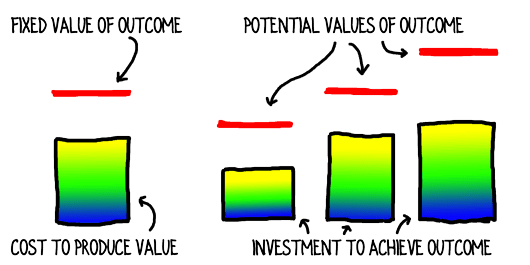

Your Clients and Your Firm’s Role

As a cost-oriented consultancy, you take on clients who perceive a limited, fixed value to the outcome of your project.

Hence, you help your clients envision how to minimize the cost to achieve their end.

As an investment-oriented consultancy, you only partner with clients who understand every project could result in various successful outcomes, with vastly different impact.

Hence, you educate your clients on the paths to different levels of success.

AI Adoption

If you’re operating from a cost mindset, your primary focus for AI is how to save time and labor by streamlining processes.

Or you minimize your AI expenditures, waiting for proven cost-saving applications.

If you’re operating from an investment mindset, your primary focus for AI is how to enhance the client experience, upgrade your deliverables, and produce outcomes that were previously unattainable.

Use of Staff and Contractors

Your cost mindset leads you to search for the lowest level employees/contractors who can do the work, and you resist hiring.

Labor is viewed as an expense to be minimized.

Your investment mindset leads you to search for employees/contractors who can radically increase the value you deliver.

Labor is an investment in your ability to wow clients, maximize value and, ultimately, boost income.

Do you have a cost mindset, an investment mindset, or some mix of the two?

How does that affect your approach to consulting?

Text and images are © 2026 David A. Fields, all rights reserved.

David A. Fields Consulting Group

David A. Fields Consulting Group

I love your stuff, it’s creative, relevant and glass half full inspiring. Thank you David.

Three cheers for inspiring, Jody! Ironically, my very first boss after I graduated taught me, “David, the glass isn’t half empty, and it’s not half full. There’s 6oz of water in a 12oz glass.” Looks half full to me! ????

Thanks for sharing your feedback, Jody–it’s much appreciated.

In a more integrative, maybe Asian philosophy-inspired view, the glass could be both half empty and half full. From a scientific perspective, it’s full – half water, half air.

Love that, Franziska. You would have been very in sync with the first boss I mentioned in response to Jody’s comment. Holding all realities in your head an acting on all of them is a rare skill. Very impressive, Franziska!

Love these insights as we consider big decisions in 2026 for labor, software, AI tools and more! I think I am a mix of both but as my firm grows, so does my confidence to have an investment mindset.

That’s terrific, Jill, and it totally makes sense that as you gain confidence, your willingness to invest increases. That’s natural risk-management kicking in.

As you consider your big investments for your firm in 2026, don’t forget to invest at the strategic level, not just in “things” like AI.

I’m so glad you joined the conversation, Jill!

Great insights David, thank you! This mirrors something I heard about a few years ago regarding finances. The speaker, Garret Gunderson, author of “Killing Sacred Cows: Overcoming the Financial Myths that are Destroying your Prosperity,” defined scarcity as:

“…the belief that resources are limited and the world is a stages for a zero-sum game of accumulation.”

That, unfortunately, is how most of the world operates. However, it does come at a cost. Equally unfortunate is the challenge in changing ingrained ways of thinking.

The opposite of scarcity is abundance, which you hinted at in your piece. Garret explains this as:

“How can you be more abundant? Living in the world of innovation, of value creation, of human ingenuity and looking at this impact of how do you serve more people or solve bigger problems because there’s huge payoffs in that.”

Anyway, don’t know if you’ve ever heard of Garret, but your piece reminded me of him. Solely focusing on costs can end up hurting you in the long run. However, it must be done carefully to ensure you have the resources available to cover those expenses.

Very good points, Nathan, and the connection to Gunderson’s work is very apt. The abundance/scarcity mindset is probably closely correlated to investment vs. cost thinking. In fact, it may be causal. You’re also right that it’s not easy to act on an investment philosophy if your outlook is scarcity-minded.

There is, as you pointed out, a difference between being abundance-minded and being pollyanish. Balance is always good.

Thank you for jumping in today, Nathan!!